Offshore Trust Setup Costs and Fees: What to Expect

Offshore Trust Setup Costs and Fees: What to Expect

Blog Article

Checking Out the Key Features of an Offshore Trust Fund for Wide Range Monitoring

Offshore trust funds have actually gotten focus as a tactical device for wealth monitoring. They supply distinctive benefits such as property defense, tax obligation optimization, and improved privacy. These trusts can be customized to meet certain monetary goals, guarding possessions from prospective dangers. There are crucial factors to consider to keep in mind - Offshore Trust. Recognizing the ins and outs of offshore trusts may disclose even more than just benefits; it could uncover prospective difficulties that warrant mindful idea

Understanding Offshore Trusts: A Primer

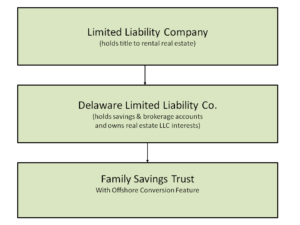

Although overseas depends on may seem complex, they offer as important financial devices for individuals looking for to manage and protect their wealth. An offshore depend on is a lawful setup where an individual, referred to as the settlor, transfers assets to a trustee in an international territory. This framework enables for enhanced personal privacy, as the details of the count on are not subject and often private to public analysis. In addition, overseas trusts can supply adaptability relating to possession monitoring, as trustees can be selected based upon knowledge and jurisdictional advantages. They can also be tailored to fulfill details monetary goals, such as estate planning or tax optimization. Comprehending the legal and tax effects of overseas trusts is necessary, as guidelines differ substantially throughout various countries. On the whole, these trusts offer a strategic method to riches administration for those aiming to navigate complex financial landscapes while delighting in particular benefits that domestic trusts may not offer.

Possession Security: Shielding Your Wealth

Property defense is an essential factor to consider for individuals seeking to safeguard their wealth from potential legal claims, creditors, or unexpected financial setbacks. Offshore counts on function as a calculated tool for accomplishing this goal, providing a layer of security that residential assets might lack. By moving assets into an overseas trust, individuals can create a lawful obstacle between their wealth and possible claimants, efficiently securing these assets from suits or insolvency proceedings.The territory of the overseas trust typically plays an essential function, as several countries provide durable legal structures that secure depend on possessions from exterior cases. In addition, the anonymity supplied by offshore counts on can better discourage creditors from pursuing cases. It is crucial for individuals to recognize the certain laws regulating asset security in their picked territory, as this knowledge is basic for making best use of the efficiency of their riches management techniques. In general, overseas trust funds stand for an aggressive method to maintaining riches versus unpredictable economic obstacles.

Tax Benefits: Browsing the Fiscal Landscape

Offshore trust funds use considerable tax benefits that can enhance wealth monitoring techniques. They offer possibilities for tax deferral, permitting possessions to expand without prompt tax obligation implications. Furthermore, these trust funds may provide estate tax benefits, additionally maximizing the economic heritage for beneficiaries.

Tax Obligation Deferment Opportunities

Exactly how can individuals take advantage of offshore depend maximize tax obligation deferral chances? Offshore depends on provide a calculated method for delaying taxes on revenue and resources gains. By positioning properties in an offshore depend on, people can take advantage of jurisdictions with beneficial tax programs, permitting potential deferral of tax obligations till circulations are made. This system can be especially beneficial for high-income income earners or investors with substantial funding gains. In addition, the earnings produced within the trust might not be subject to prompt tax, allowing wealth to grow without the worry of annual tax obligation obligations. Steering via the complexities of global tax legislations, individuals can properly use overseas depend enhance their riches administration approaches while lessening tax exposure.

Inheritance Tax Benefits

Privacy and Confidentiality: Keeping Your Matters Discreet

Maintaining personal privacy and confidentiality is necessary for individuals looking for to safeguard their riches and properties. Offshore trusts provide a durable structure for guarding personal info from public analysis. By developing such a trust, individuals can effectively divide their individual events from their economic rate of interests, guaranteeing that sensitive information continue to be undisclosed.The lawful structures controling offshore depends on commonly provide solid privacy protections, making it difficult for external parties to access information without approval. This degree of discretion is specifically interesting high-net-worth individuals worried regarding potential threats such as lawsuits or undesirable attention from creditors.Moreover, the distinct nature of overseas jurisdictions improves privacy, as these areas usually impose rigorous guidelines surrounding the disclosure of count on information. People can take pleasure in the peace of mind that comes with understanding their financial approaches are protected from public understanding, thus maintaining their wanted level of discretion in wealth management.

Versatility and Control: Tailoring Your Count On Framework

Offshore counts on give significant flexibility and control, permitting individuals to customize their count on frameworks to fulfill certain monetary and individual objectives. This adaptability allows settlors to pick different elements such as the kind of assets held, distribution terms, and the consultation of trustees. By picking trustees who line up with their goals and values, people can guarantee that their riches is handled in accordance with their wishes.Additionally, offshore trusts can be structured to fit changing situations, such as fluctuations in financial requirements or household characteristics. This means that beneficiaries can get distributions at specified intervals or under specific conditions, giving additional modification. The capacity to modify trust arrangements likewise ensures that the trust fund can evolve in reaction to lawful or tax obligation modifications, preserving its efficiency over time. Inevitably, this level of versatility equips people to this produce a trust fund that lines up seamlessly with their long-term wealth administration approaches.

Potential Downsides: What to Take into consideration

What obstacles might people deal with when thinking about an offshore trust fund for wide range monitoring? While offshore trusts provide various advantages, they likewise come with possible downsides that necessitate careful factor to consider. One considerable concern is the cost connected with establishing and maintaining such a trust, which can consist of legal charges, trustee fees, and ongoing administrative expenses. Additionally, people may come across intricate governing needs that differ by jurisdiction, possibly complicating conformity and bring about charges if not complied with properly. Offshore Trust.Moreover, there is an inherent danger of currency fluctuations, which can influence the value of the properties kept in the count on. Trust recipients may also face difficulties in accessing funds due to the management procedures involved. Finally, public perception and possible scrutiny from tax obligation authorities can produce reputational threats. These factors require complete research and expert guidance prior to continuing with an offshore count on for wide range management

Key Factors To Consider Before Developing an Offshore Depend On

Before developing an offshore trust fund, individuals need to think about several vital aspects that can considerably impact their wealth management method. Legal territory effects can affect the depend on's effectiveness and compliance, while taxation factors to consider may affect total benefits. A comprehensive understanding of these components is essential for making educated decisions pertaining to offshore counts on.

Lawful Jurisdiction Effects

When considering the facility of an offshore trust fund, the option of lawful territory plays a pivotal duty fit the trust fund's effectiveness and safety. Different jurisdictions have varying regulations governing trust funds, including guidelines on possession defense, privacy, and compliance with global standards. A territory with a durable legal structure can boost the depend on's legitimacy, while those with much less strict legislations might position threats. Additionally, the credibility of the chosen territory can impact the trust fund's perception amongst recipients and banks. It is essential to review factors such as political stability, lawful criteria, and the accessibility of experienced fiduciaries. Inevitably, picking the look at these guys appropriate territory is crucial for achieving the wanted goals of property protection and wealth management.

Tax Considerations and Benefits

Taxation factors to consider greatly influence the choice to develop an overseas trust fund. Such trusts might provide substantial tax obligation advantages, including lowered revenue tax liability and potential estate tax advantages. In several territories, earnings generated within the trust can be strained at reduced rates or not at all if the recipients are non-residents. Additionally, properties held in an overseas count on might not go through residential inheritance tax obligations, assisting in wide range conservation. It is essential to navigate the complexities of worldwide tax laws to assure compliance and avoid risks, such as anti-avoidance policies. Consequently, individuals should speak with tax obligation specialists experienced in offshore frameworks to enhance advantages while adhering to applicable legislations and regulations.

Regularly Asked Questions

Exactly how Do I Select the Right Jurisdiction for My Offshore Count on?

Picking the best territory for an offshore trust includes reviewing factors such as lawful stability, tax ramifications, governing atmosphere, and privacy legislations. Each jurisdiction provides unique benefits look at here that can significantly impact riches monitoring techniques.

Can I Modification the Recipients of My Offshore Trust Later On?

The ability to change recipients of an offshore depend on depends upon the trust fund's terms and administrative legislations. Typically, several overseas trusts allow alterations, however it is necessary to speak with legal suggestions to assure compliance.

What Is the Minimum Quantity Needed to Establish an Offshore Trust Fund?

The minimum quantity required to establish an overseas trust fund varies significantly by territory and company. Typically, it ranges from $100,000 to $1 million, depending on the intricacy of the trust and associated fees.

Are There Any Type Of Lawful Restrictions on Offshore Depend On Investments?

The legal limitations on overseas depend on investments differ by territory. Normally, regulations may limit specific possession types, impose coverage needs, or limit purchases with certain countries, guaranteeing compliance with international laws and anti-money laundering steps.

How Do I Liquify an Offshore Trust Fund if Needed?

To liquify an overseas depend on, one should follow the terms laid out in the depend on act, ensuring compliance with applicable laws. Lawful recommendations is typically suggested to browse possible intricacies and identify all obligations are met. By moving assets right into an offshore depend on, people can create a lawful barrier in between their wealth and potential plaintiffs, effectively securing these assets from legal actions or bankruptcy proceedings.The jurisdiction of the offshore trust fund usually plays an essential role, as lots of nations use durable lawful frameworks that secure trust fund possessions from outside insurance claims. By establishing such a depend on, people can effectively separate their individual events from their monetary passions, guaranteeing that sensitive information continue to be undisclosed.The legal frameworks controling overseas trust funds commonly supply strong personal privacy defenses, making it difficult for external parties to gain access to details without authorization. Offshore counts on supply significant versatility and control, permitting people to customize their trust fund frameworks to fulfill particular monetary and individual objectives. When considering the facility of an overseas trust fund, the selection of legal territory plays a crucial role in shaping the depend on's effectiveness and safety. The capacity to change beneficiaries of an offshore trust depends on the trust's terms and administrative legislations.

Report this page